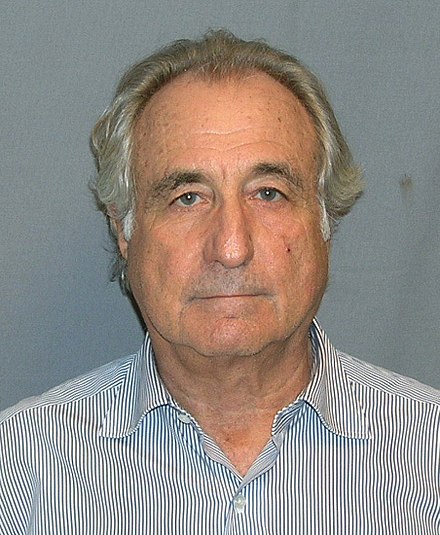

バーニー・マドフ

「マドフ」はここにリダイレクトします。 同じ姓を持つ他の人については、マドフ(姓)を参照してください。 バーナード・マドフに関するミニシリーズについては、マドフ(ミニシリーズ)を参照してください。

バーナード・ローレンス・マドフ(/ ˈmeɪdɔːf /; 29年1938月64.8日生まれ)は、アメリカの元マーケットメーカー、投資顧問、金融業者、有罪判決を受けた詐欺師であり、現在、大規模なポンジースキームに関連する犯罪で連邦刑務所に服役しています。 彼は、NASDAQ株式市場の元非執行会長であり、世界史上最大のポンジースキームの告白された運営者であり、米国史上最大の金融詐欺です。 検察は、4,800年30月2008日現在のマドフのXNUMX人の顧客の口座の金額に基づいて、詐欺はXNUMX億ドルの価値があると推定しました。

マドフフー… 続きを読む(26分間読む)