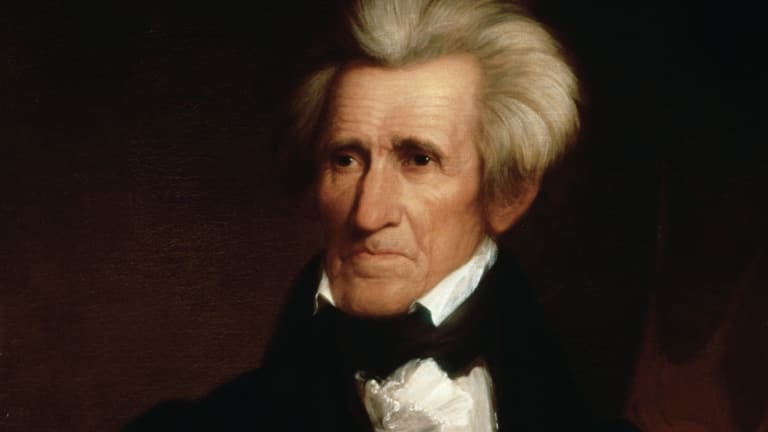

As a Major General in the War of 1812, Andrew Jackson rose to national prominence. During his career, he successfully led American forces in several battles, most notably the Battle of New Orleans. In 1829, Andrew Jackson was elected as the seventh President of the United States and served two terms until 1837. But did you know what Andrew Jackson’s biggest achievement was?

President Andrew Jackson successfully paid off the United States’ debt in 1835. This is the only time in history that this has happened.

Andrew Jackson Paying Off the Debt of the United States

The national debt’s elimination was a personal issue for Jackson and the culmination of a political project as old as the country itself. Since the Revolution, American politicians have debated the wisdom of the country being in debt.

As part of the former colonies’ unification, the federal government agreed to assume individual states’ war debts after independence. Federalists, supporters of a stronger central government, established a national bank and argued that debt could be used to fuel the new country’s economy. Their detractors, most notably Thomas Jefferson, believed that these policies favored Northeastern elites at the expense of rural Americans and that the debt was a source of national shame.

Jackson, a populist whose Democratic Party arose from Jefferson’s Democratic-Republican Party, had a personal aversion to debt stemming from a land deal gone sour during his days as a speculator. In his re-election campaign in 1832, Jackson vetoed the rechartering of the national bank, calling the debt a moral failing and black magic.

During his presidency, Jackson vetoed several spending bills, effectively killing projects that would have expanded national infrastructure. He further reduced the debt by selling vast government land in the West and could pay it off entirely in 1835. (Source: History)

The One and Only to Achieve Such Feat

The national debt was approximately $58 million when Jackson took office. It was all gone six years later. Paid in full. And the government was running a surplus, meaning it was taking in more money than it was spending.

Jackson’s victory sowed the seeds of the economy’s demise. The privatization of federal lands had resulted in a real estate bubble, and the end of the national bank had resulted in reckless spending and borrowing. These issues, combined with other aspects of Jackson’s fiscal policy and downturns in foreign economies, precipitated the 1837 Panic. A bank run and subsequent depression devastated the US economy, forcing the federal government to resume borrowing.

Since then, the United States has been in debt. The debt skyrocketed during the Civil War but was nearly paid off by the early twentieth century, only to soar again with the outbreak of World War I. Several presidents and politicians have decried the debt and even pledged to eliminate it, with conservatives and libertarians frequently echoing Jackson. Nonetheless, with the national debt exceeding $22 trillion, it is unlikely that the events of 1835 will be repeated soon. (Source: History)